Overstating Promo Credits Comes with Hefty Fine of $75,000 for Borgata

1.0

Default

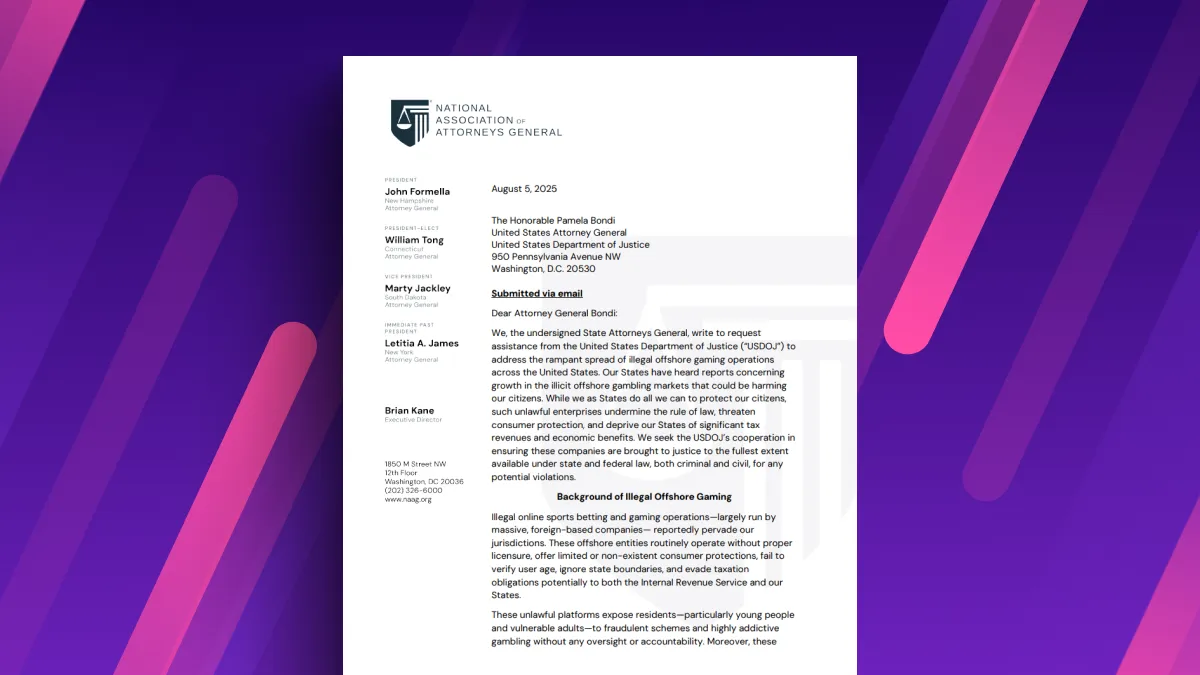

The second time comes with a penalty: The New Jersey Division of Gaming Enforcement has once again found Borgata has overstated its promotional credits. The first time was around 18 months ago, and this time, it comes with a hefty penalty of $75K.

The New Jersey Division of Gaming Enforcement (NJDGE) has imposed a $75,000 fine on Borgata in Atlantic City after the casino operator overstated its promotional credits by a total of $4.6 million, leading to an underpayment of $365,161 in taxes. The penalty comes after the NJDGE discovered that a software upgrade to the online casino system of BetMGM New Jersey caused inaccurate reporting of promotional credits, which inflated the reported figures.

Borgata Atlantic City, a prominent player in New Jersey's online gaming sector, operates several online casinos in NJ. This recent incident marks the second time in just 18 months that Borgata has been found guilty of similar misconduct. In March 2023, the casino overstated its promotional credits by a staggering $9.9 million, which resulted in over $787,000 in underpaid taxes.

Software glitch leads to misreporting

The NJDGE's investigation revealed that a software upgrade implemented by BetMGM, one of Borgata's online platforms, was at the heart of the problem. The upgrade caused the system to erroneously report more promotional credits than were actually awarded to players. These overstated figures, in turn, led to an understatement of gross revenue and a consequent shortfall in the taxes owed to the state.

In its formal communication to Borgata, the NJDGE expressed grave concerns over the repeated nature of this violation. The letter highlighted the severity of the infraction, noting, "The Division views this matter as serious. The original violation was an understatement of gross revenue by almost $10 million. This second understatement of gross revenue was in an amount of over $4.5 million. These understatements resulted in the assessment of additional taxes, tax penalties, and interest of over $1.3 million."

The NJDGE further emphasized that the recurrence of such an issue within a relatively short time frame was particularly troubling. "The fact that this conduct was repeated less than 18 months after the Division warned an additional violation of this type could result in a civil penalty is also to be considered," the letter continued. The Division did acknowledge, however, that Borgata acted promptly to remedy the tax underpayment in both instances and implemented software fixes to prevent future occurrences of similar errors.

Second offense in 18 months

The NJDGE's decision to impose a fine this time around is a marked departure from its handling of the first incident in March of 2023. Back then, despite the significant amount involved, the Division opted not to impose a financial penalty on Borgata, instead issuing a stern warning. The NJDGE's warning letter in 2023 stated, "This letter is also intended to serve as a reminder to Borgata and BetMGM of the requirements related to Internet gaming PGCs and the need for Division approval before any deductions are taken."

The warning concluded with a clear indication that future violations would not be met with the same leniency. "In this instance, the Division has decided not to impose any financial penalty for this regulatory violation, and thus, only the gross revenue tax, penalty, and interest are due and payable in accordance with the above," the letter read. However, the NJDGE made it unequivocally clear that another infraction could result in fines, and that warning has now come to fruition.

The $75,000 fine serves as a reminder of the NJDGE's commitment to maintaining the integrity of New Jersey's gaming sector. With Borgata now facing financial penalties for its repeated violations, the NJDGE has demonstrated that it will not tolerate ongoing non-compliance with regulatory requirements, especially when it comes to accurate reporting and tax payments.