Nevada Rep. Fights to Restore Gambling Loss Deductions

1.0

Default

A representative from the state of Nevada, Rep. Dina Titus, has proposed new legislation following an overlooked provision on the recently-signed One Big Beautiful Bill. The proposed legislation seeks to allow bettors to write off a hundred percent of their losses in gambling.

Nevada Congresswoman Dina Titus has recently introduced new legislation to reverse a controversial provision buried in former President Donald Trump's latest budget bill - one that significantly impacts professional gamblers and high-stakes bettors. The budget bill, dubbed the 'One Big Beautiful Bill Act,' was signed into law on the 4th of July, but not without criticism, especially from Titus and the gambling community.

The Democrat from Las Vegas introduced the FAIR BET Act last Monday, which aims to reinstate the full 100% federal tax deduction for gambling losses. Under the new law, bettors can only deduct 90% of their losses, even while being required to report 100% of their winnings - effectively taxing profit that doesn't exist.

High stakes, higher taxes

The gambling provision was inserted into the bill by the Senate after the House passed the original budget with minor changes. The intention was to save federal dollars, especially as the bill is expected to balloon the national deficit by over $4 trillion across the next decade.

The change, however, directly affects players at all levels - particularly professional gamblers and high-volume bettors. According to Jeff Edelstein of InGame.com, the math is alarming: If you win $100,000 and lose $100,000, you can only deduct $90,000. That leaves you taxed as if you made $10,000 - even though your net gain is zero, he wrote. At a 24% federal tax rate, that results in a $2,400 tax bill on imaginary profit.

Titus, whose district includes parts of Las Vegas, was swift in her response. "No one should have to pay taxes on money they didn't win," she posted on X. She is co-sponsoring the FAIR BET Act with Rep. Rohit Khanna.

Poker pros and the industry sound the alarm

Professional poker player Phil Galfond voiced his strong opposition to the provision, illustrating its severe financial consequences on full-time players. Let's say you win $5.2 million but lose $5 million, he explained. You really made $200,000. But under this law, you're taxed as if you made $700,000, he added. He also warned that such a scenario would make professional gambling in the US financially untenable.

Galfond emphasized that this could devastate poker rooms and betting markets that rely on professional participation to create liquidity and competitiveness. "You take them out, and the ecosystem collapses," he said.

Jeff Edelstein echoed this concern, noting that high-volume players - often called 'sharps' - are essential for setting accurate sportsbook lines and maintaining healthy daily fantasy contest pools. "These aren't whales throwing around money. They're skilled, data-driven professionals," he wrote.

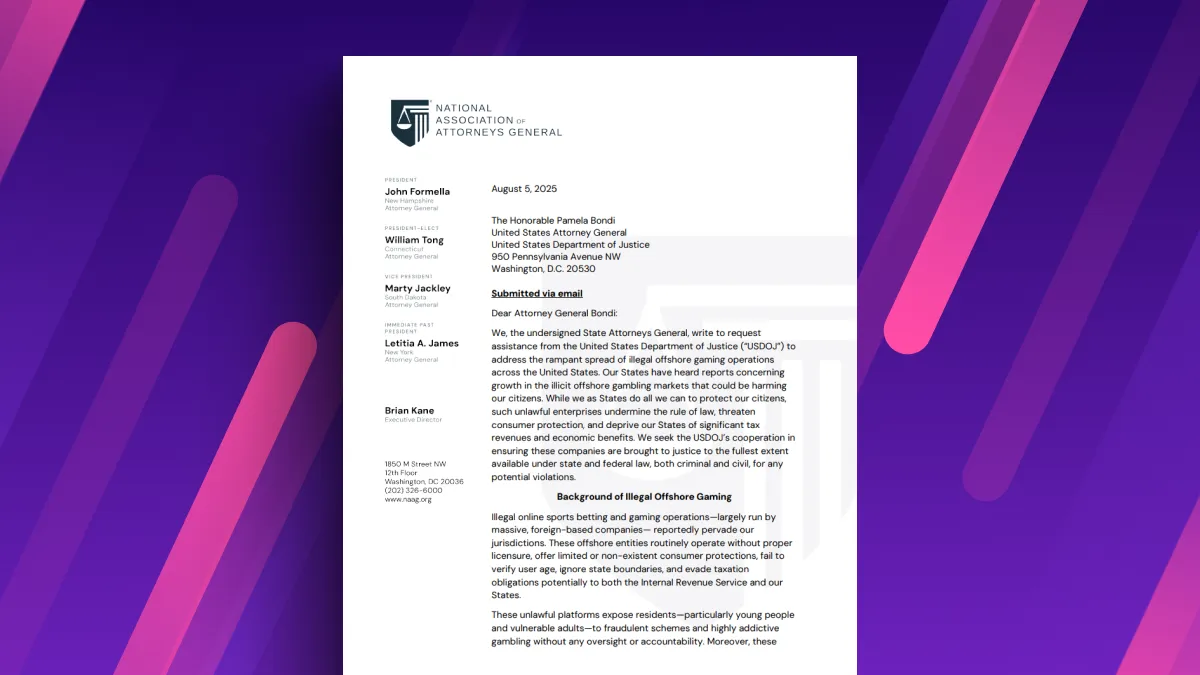

A push toward offshore gambling?

Titus also expressed concern that the new tax rules would drive players toward offshore betting platforms, which are not subject to US regulation or taxation. "Players will go gamble with offshore operators," Galfond warned, "and the US will not see those tax dollars."

Offshore sites typically do not enforce responsible gaming measures or provide consumer protections such as anti-money laundering compliance. Titus highlighted this in an interview, stating, "The black market doesn't pay taxes, isn't regulated, and doesn't help with problem gaming. It's bad for the industry as well as the player."

Industry support for FAIR BET Act

The American Gaming Association issued a statement backing Titus' proposed fix, saying, "We are committed to working with Congresswoman Titus, other congressional leaders, and the Trump administration to restore the long-standing tax treatment of gaming losses."

With more than two dozen states now offering legalized sports betting, lawmakers like Titus are advocating not only for fair tax policy but also to protect a growing, regulated industry. "I encourage other members to support this critical fix," she said on social media.