Las Vegas Casino Revenue Jumps for First Time in Months

1.0

Default

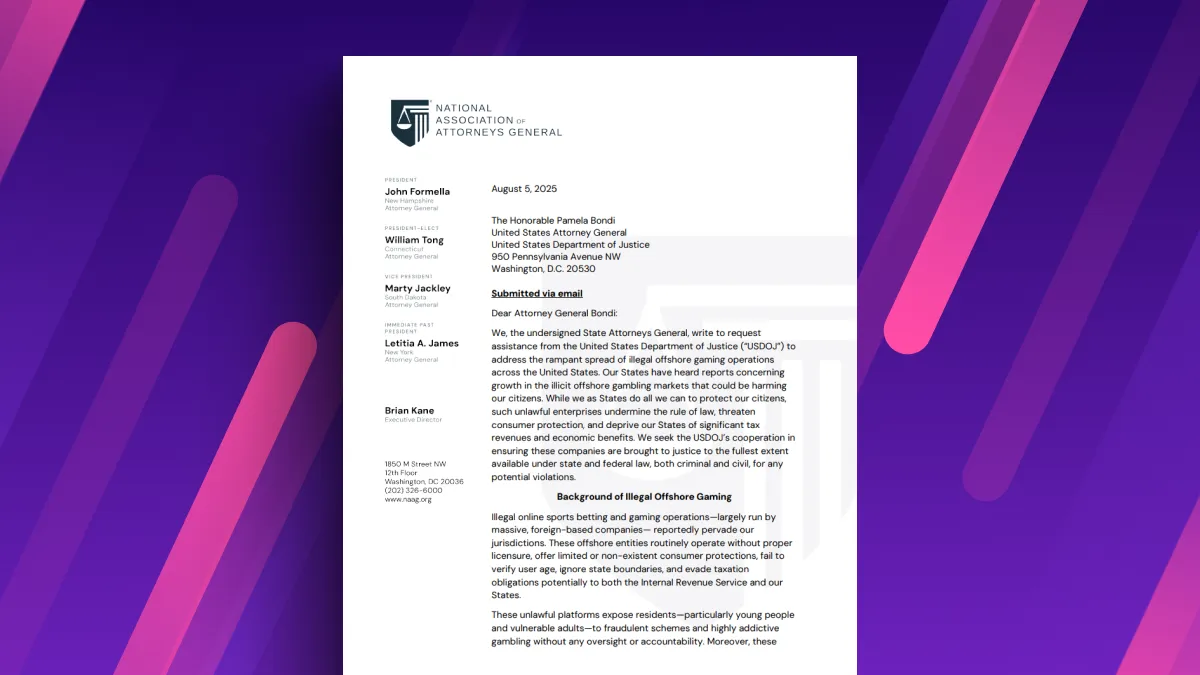

Casino revenue at the Las Vegas Strip showed signs of rebounding after four straight months of drought, but there are still some concerns regarding Las Vegas' economic forecast for the year. According to the Nevada Gaming Control Board, gross gaming revenue at the Las Vegas Strip was at a high of over $765 million, which was a slight improvement from the first four months of the year.

After four consecutive months of declining gaming revenue, the Las Vegas Strip finally reversed its slide in June of 2025. According to figures released Wednesday by the Nevada Gaming Control Board, the Strip posted gross gaming revenue of $765.3 million - a modest 0.9% increase from last year. This marks the first positive monthly report for the iconic stretch since January.

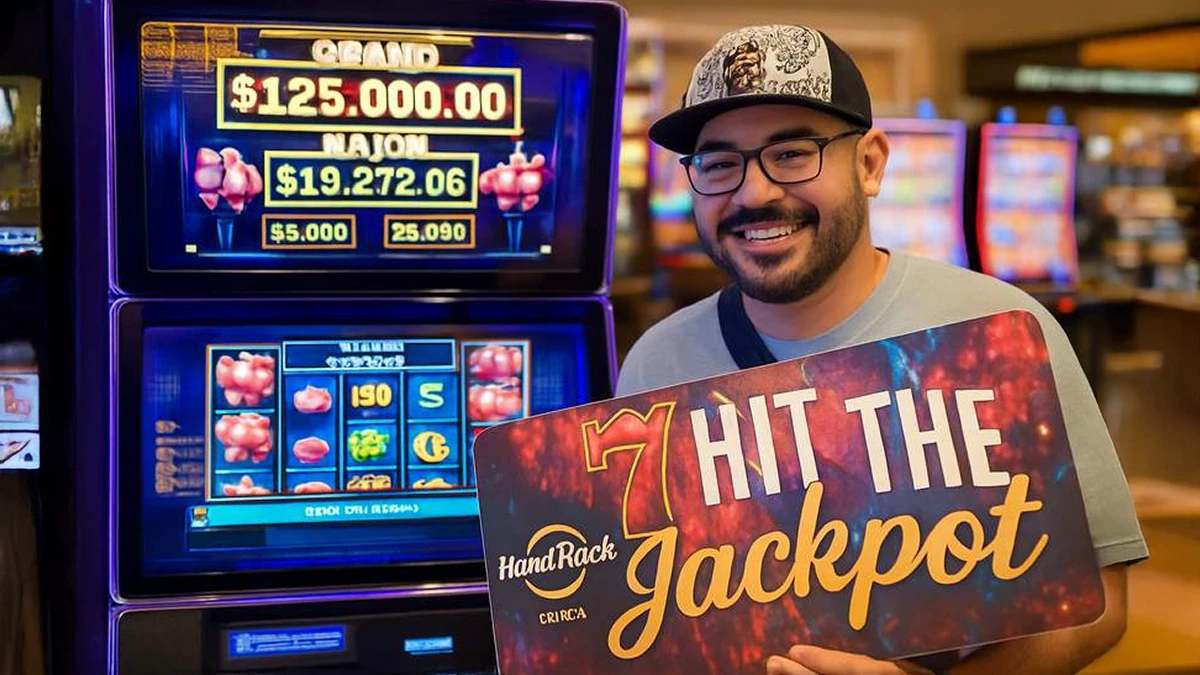

The turnaround, while slight, brings a measure of relief to casino operators and investors who have grown increasingly concerned about the Strip's performance amid the broader economic uncertainty. The uptick was largely fueled by strong slot play, with slot machines generating $420.2 million in revenue - up 10% compared to the same period in 2024.

Table games, on the other hand, continued to struggle. Blackjack, roulette, and craps all experienced revenue drops exceeding 20%, with every major table game posting lower returns - except Ultimate Texas Hold'em, which narrowly avoided the downturn. Sportsbooks were another bright spot, recording $20.4 million in GGR, a substantial 47% increase over the previous year.

Statewide gains boost confidence

While the Strip's gains were modest, Nevada's gaming industry as a whole performed more robustly in June. Statewide GGR climbed 3.5% to as much as $1.33 billion, buoyed by strength in the locals' market. According to Barry Jonas, a Truist Securities analyst, local gaming markets rose 10% in the month of June and 4% overall for the second quarter.

Downtown Las Vegas posted a 10.5% gain to $73.2 million in GGR. Laughlin rose to $40 million, up by 7%, Boulder surged 19% to as much as $87.3 million, and Reno saw a 6% increase to $67.8 million. However, over the past 12 months, Nevada's overall GGR is still down nearly 1%, totaling approximately $15.63 billion.

Tourism declines threaten recovery

Despite the welcome gaming boost, Las Vegas continues to face troubling trends in tourism and hospitality. June visitor numbers revealed a sharp 11.3% drop compared to the same month last year, with just over 3.09 million travelers coming to Southern Nevada. Convention attendance was similarly down, falling nearly 11% to only 374,600. The Las Vegas Convention & Visitors Authority attributed the declines to "persistent economic uncertainty and weaker consumer confidence," noting that these factors have heavily influenced travel behaviors in 2025.

Hotel occupancy also suffered, dropping 6.5% to only 78.7% in June. Average daily room rates fell to $164 across the city and $174 on the Vegas Strip. Year-to-date figures paint an even bleaker picture: Las Vegas has hosted 1.54 million fewer visitors in the first six months of the year, a 7.3% year-over-year decrease. Revenue per available room has dropped nearly 8%, with average nightly rates falling by 5.5%.

Air travel also slides

Contributing to the visitation decline is a slump in air travel. Harry Reid International Airport reported 4.72 million passengers in June, a 6% decrease compared to last year. This brings the year-to-date air traffic drop to 4.1%, with 1.19 million fewer passengers arriving and departing through the first half of 2025. Both domestic and international travel showed declines. Domestic air passenger counts fell 6.1%, while international traffic dropped by about 10%.

While June's GGR improvement on the Strip offers a glimmer of hope, industry observers caution that a true recovery will depend on stronger tourism numbers and a rebound in consumer spending. With higher operational costs, casino operators will need more than a 1% increase in gaming revenue to return to meaningful profitability.

Still, some analysts remain cautiously optimistic. If slot play continues its upward trend and local markets hold strong, the Las Vegas Strip may yet regain its footing heading into the latter half of 2025.