Japan All Set to Reopen Bidding on Casinos While Millions Bet Illegally

1.0

Default

Japan may be ready to resume bidding for casino licenses next year in response to a gaming law that was issued in 2018. Seven years on, only a single casino license has been awarded to MGM Resorts International and construction is only just beginning. Meanwhile, there are still two licenses on offer, and millions of Japanese are reportedly gambling illegally online.

Japan is reportedly thinking seriously about reopening its casino bidding process in 2025 to fulfill its 2018 gaming law, which allows for the development of up to three integrated resorts (IRs). With only one casino license awarded to date and millions of Japanese residents engaging in illegal online gambling, the government may be looking to accelerate the industry's expansion.

Slow progress in Japan's casino industry

In 2018, the National Diet approved legislation permitting large-scale casino resorts as part of a strategy to boost tourism and economic growth. However, seven years later, only a single casino license has been granted, and construction is just beginning.

The slow progress can be attributed to the country's deliberate rulemaking procedures, the global pandemic, and economic challenges that deterred major casino operators. Initially, several high-profile firms, including Las Vegas Sands, Wynn Resorts, Melco Resorts, Genting Group, Hard Rock International, and Galaxy Entertainment, expressed interest. However, by 2020, most of them had withdrawn due to uncertainties and rising costs.

MGM Resorts International remained committed and was ultimately granted a license for an $8 billion development in Osaka, in partnership with Japan's Orix Corporation. Meanwhile, a proposal from Casinos Austria for a Nagasaki casino was rejected.

Potential reopening of bidding

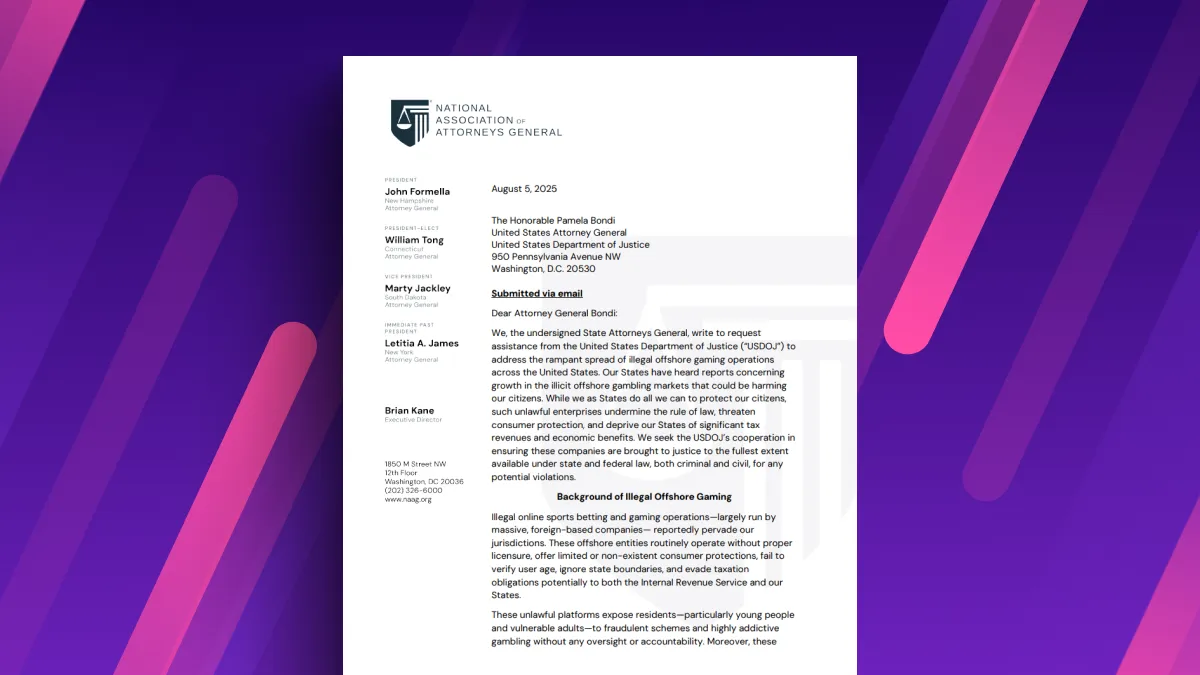

According to experts, Japan could relaunch the bidding process for two additional IR licenses next year. However, the Japanese government has yet to make an official announcement. Industry analysts are questioning whether previously interested casino operators would be willing to revisit their investment plans in Japan. A major challenge lies in the increasing competition from Thailand, which is in the process of legalizing casino resorts in key locations such as Bangkok, Phuket, and Chiang Mai. Companies such as Genting, Sands, Wynn, and MGM have all stated their interest in Thailand's market, which could divert investment away from Japan.

"There are only a few quality bidders that have the financial strength to participate in more than one project," said a gaming sector executive. "Based on the terms as we know today, the Thai license will have priority."

Illegal online gambling in Japan

While Japan's land-based casino industry remains in its infancy, millions of residents are already engaging in online gambling through unregulated offshore websites. A recent report from the National Police Agency of Japan estimated that approximately 3.4 million individuals in the country gambled online in 2024, with many unaware that their activity was illegal.

Authorities reported that around ¥1.24 trillion or US$8.4 billion was wagered online last year. The study found that roughly 40% of online gamblers did not realize their actions violated Japanese law. Furthermore, three-quarters of online players started on free social casino sites and apps before transitioning to real-money gaming.

To mitigate the potential social harms associated with legal gambling, Japan has implemented strict regulations for its upcoming casino industry. Residents will be required to pay an entrance fee of ¥6,000 or US$40 and will be subject to limits on the number of times they can visit a casino each month.

The future of Japan's casino market

As Japan contemplates reopening the bidding process, the government must weigh several factors, including industry interest, competition from Thailand, and concerns over illegal online gambling. While MGM Resorts is pushing ahead with its Osaka project, the fate of additional casino developments remains uncertain.

If Japan proceeds with a second round of bidding, it will need to demonstrate clear regulatory guidelines and financial incentives to attract top-tier operators. With billions of dollars potentially at stake, the coming year will be crucial in shaping the future of Japan's casino industry.