Polymarket Expands in the US with QCEX Acquisition

1.0

Default

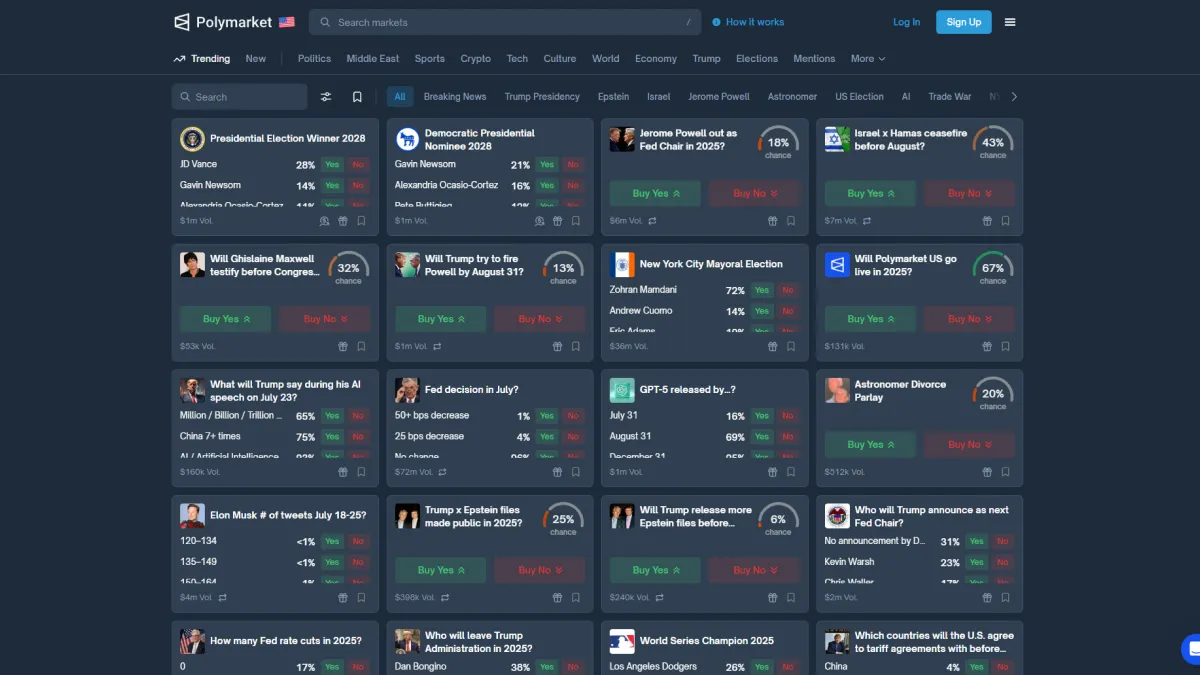

Polymarket, arguably the largest prediction platform in the world, has announced that it has acquired QCEX, a CFTC-licensed clearinghouse and derivatives exchange. With the acquisition, Polymarket can now legally expand its operations in the US market.

In a landmark deal that could reshape the future of prediction markets in the United States, Polymarket, arguably the world's leading platform for forecasting real-world events, has acquired the holding company of QCX, LLC and QC Clearing LLC - collectively known as QCEX - for $112 million. QCEX holds both a Designated Contract Market license and a Derivatives Clearing Organization license from the Commodity Futures Trading Commission, which gives Polymarket a powerful regulatory pathway to re-establish operations in the US.

The acquisition signals Polymarket's first formal move toward becoming a fully regulated entity in the United States, aiming to bring its prediction contracts to millions of American users with the full backing of federal oversight and compliance.

A vision four years in the making

For QCEX, the transaction marks the realization of a long-term goal. "When we began the process to obtain our DCM and DCO licenses over four years ago, the prediction market was in its infancy," said the founder of QCEX, Sergei Dobrovolskii. "But we have long believed in its potential to change the way people access and understand information and express their views on that information," he added.

Dobrovolskii additionally praised Polymarket's rapid rise as a cultural and financial force, saying, "Shayne (Coplan) has built a cultural phenomenon in Polymarket. I am excited to bring our companies together and leverage our licenses, technology, and expertise in the retail trading sector to help Polymarket reach its full potential."

Building a regulated future for prediction markets

Polymarket has become a central hub for real-time speculation on everything from politics and economics to pop culture. During the first half of 2025, the platform saw nearly $6 billion in trading volume, demonstrating its growing influence among individuals and institutions seeking to measure and understand public sentiment.

Founder and Chief Executive Officer Shayne Coplan said the deal with QCEX represents more than just expansion. "Polymarket is the largest prediction market globally and has become synonymous with understanding the probability of current events," he stated. "Now, with the acquisition of QCEX, we are laying the foundation to bring Polymarket home - re-entering the US as a fully regulated and compliant platform that will allow Americans to trade their opinions."

A cultural phenomenon with mainstream reach

In recent months, Polymarket has only strengthened its grip on the public imagination. A newly announced partnership with X has further integrated Polymarket into the daily conversations of global users, blurring the lines between market sentiment, real-time news, and social media engagement.

As prediction markets gain traction in both finance and media, Polymarket continues to set the standard for clarity, accuracy, and relevance. With the acquisition of QCEX, the company is now positioned to expand access in the United States - offering a legal and regulated channel for US-based traders to participate in its growing ecosystem.

Polymarket is arguably the world's largest and most active prediction market platform. Traders on Polymarket wager on the outcome of future events, with market prices reflecting the collective belief in how likely those outcomes are to occur. As users respond to breaking news and political shifts in real time, Polymarket offers a dynamic and data-driven view into public sentiment across every sector - from politics and finance to entertainment and culture. In 2025 alone, billions of dollars in forecasts have been traded on the platform.

_800x800.webp)